Beginner’s Guide: What Are Smart Contracts?

Since the first Bitcoin emerged in 2009, blockchain technology has permeated various aspects of our lives over the past nine years. From the digital currency era of Blockchain 1.0 to the smart contract era of Blockchain 2.0, each leap in blockchain technology has marked a transformative milestone.

Today, we’ll focus on smart contracts, a cornerstone of the Blockchain 2.0 era. While many crypto investors may have heard of smart contracts, some speculators fixated on trading might overlook this foundational technology. However, whether you’re an investor or a speculator, understanding smart contracts is essential.

What Are Smart Contracts?

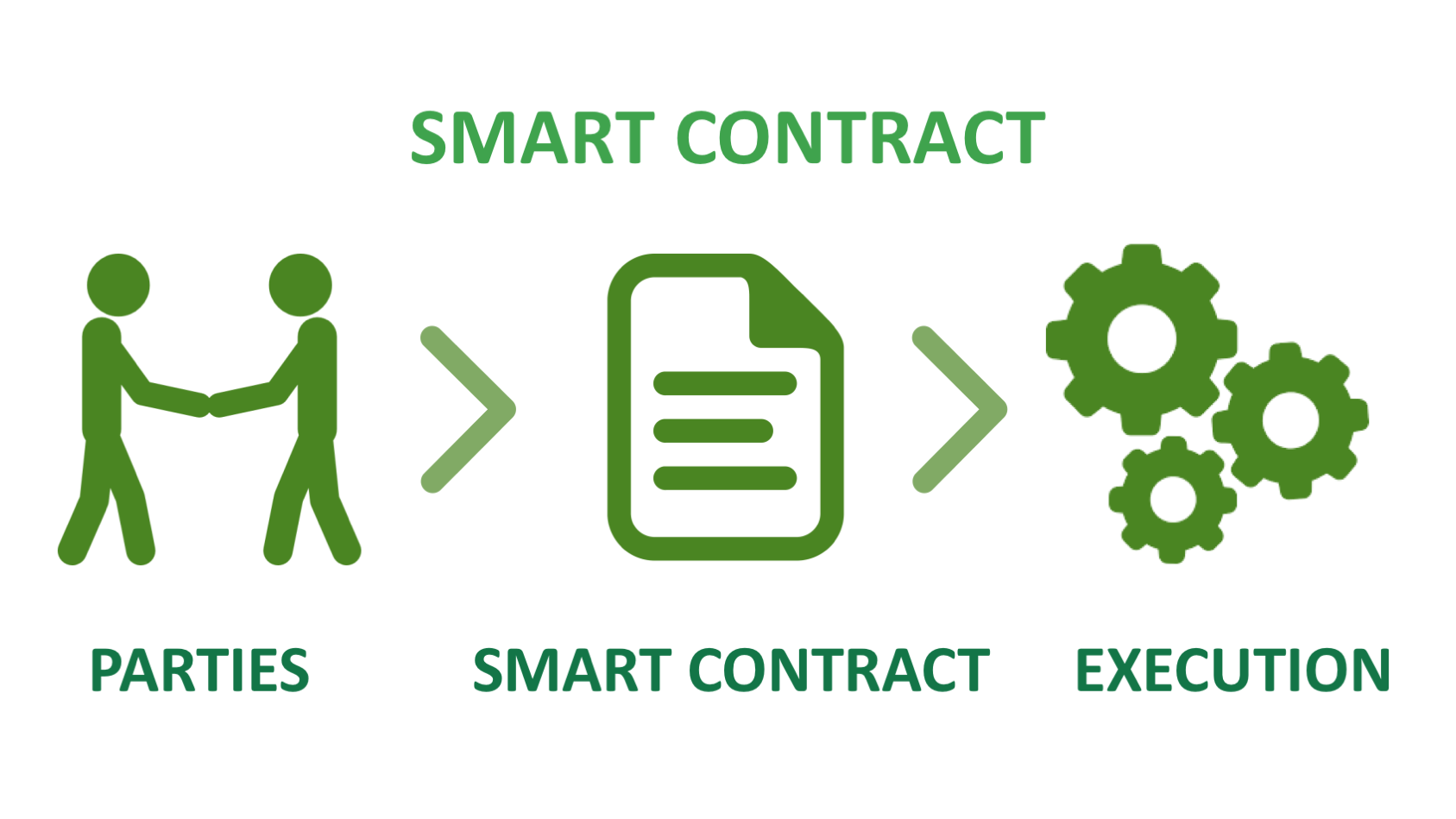

Most smart contracts today are built on Ethereum. At their core, smart contracts are not much different from traditional contracts—except for the “smart” part. The intelligence lies in encoding contract terms as code stored on an immutable blockchain. Once a condition in the contract is met, the code executes automatically. Breaching the contract is nearly impossible because the code doesn’t care if you’re a big shot or an average person—it runs as programmed, saving significant costs on human coordination and oversight.

In simple terms, smart contracts are a digital upgrade of traditional contracts. They are computer programs running on a blockchain database that execute automatically when conditions written in their source code are met. Once deployed, smart contracts are trusted by users and cannot be altered, ensuring their terms are unchangeable.

An Example

Imagine Alice and Bob betting on a soccer match between Barcelona and Real Madrid. Alice backs Barcelona, Bob supports Real Madrid, and each wagers $100. The deal: if your team loses, the winner takes the entire pot.

If both are trustworthy, there’s no issue. But if Bob loses and refuses to pay Alice, she has little recourse—verbal agreements lack enforceability, and suing over $100 is impractical.

This kind of breach is common in society, often requiring significant resources to enforce contracts. However, if the agreement is coded as a smart contract on a blockchain, the outcome changes. Once the match result is confirmed, the smart contract automatically executes the terms. If Barcelona wins, Bob’s $100 is transferred to Alice’s account instantly. In a blockchain context, the funds would be in cryptocurrency.

Applications of Smart Contracts

1. Betting Transactions

Take a Super Bowl bet as an example. You bet $500 (or one Bitcoin) on the New England Patriots, while your friend bets the same on the Green Bay Packers. You both send your Bitcoin to a neutral account controlled by a smart contract. After the game, the smart contract checks results from sources like ESPN or Reuters. If the Patriots win, it automatically sends your original stake plus your friend’s wager to your account.

Since smart contracts are computer programs, they can easily incorporate complex betting elements like odds or point spreads. While betting services exist, they charge fees. Smart contracts, being decentralized and accessible to anyone, eliminate intermediaries.

2. Online Shopping

A more common use case is online shopping. When buying an item online, you might hesitate to pay upfront, preferring to pay after the seller ships. A smart contract can solve this by tracking logistics data (e.g., from a courier like SF Express). Only when the contract confirms the item is en route to your address does it release payment to the seller. This essentially automates the escrow function of platforms like Alipay.

3. Mortgage Loans

Many routine financial tasks handled by lawyers or banks are repetitive but costly. Smart contracts can automate and demystify these processes, saving time and money.

Consider a mortgage loan. Banks typically don’t hold 30-year loans; they sell them to investors. Yet, you repay the bank, not the investor. The bank processes your payments, sending most to the investor, some to taxes, and a bit to homeowners’ insurance—a simple task. However, banks often take months to process payments and charge fees for this service. A smart contract could handle this instantly, eliminating processing fees. This reduces costs for consumers, ultimately lowering the cost of homeownership.