Recovering Losses from Crypto Theft for Retail Investors

When retail crypto investors fall victim to theft, swift and strategic action is critical to maximize the chances of recovering losses. Below is a comprehensive guide to navigating the aftermath of a crypto theft incident, focusing on on-chain tracking, engaging with exchanges, and pursuing legal recourse.

On-Chain Tracking and Asset Protection

1. Identify the Cause and Secure Remaining Assets

Upon discovering a theft, immediately determine the cause—whether it’s a compromised seed phrase or private key, use of a phishing wallet, or clicking a malicious link.

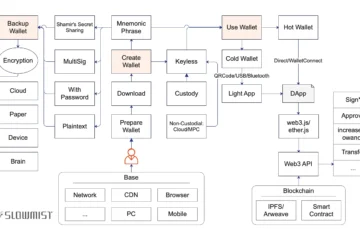

Conduct an inventory of your on-chain assets and transfer high-value holdings to a secure wallet on a trusted device. If no secure wallet is available, consider depositing assets into a reputable centralized exchange account. Major exchanges typically have robust security teams, and by securing your account with strong passwords and Google Authenticator (not SMS-based 2FA), you can mitigate many risks. Even in rare cases like the Bybit cold wallet hack, large exchanges have greater risk resilience than individual users. As a creditor of an exchange, you may recover losses over time through their fee revenue, provided the platform avoids a bank run or collapse.

For retail investors, storing assets with top-tier exchanges is often the safest option due to their security infrastructure.

2. Trace the Stolen Funds

Blockchain’s transparent nature allows stolen assets to be tracked via blockchain explorers and data analysis tools. Create a funds flow chart starting from the compromised address to serve as evidence for law enforcement. These tools can map out the path of stolen assets, providing critical clues for investigations.

3. Request Temporary Exchange Freezes

If stolen funds are transferred to a centralized exchange, contact the exchange’s customer service or key account manager to request a temporary risk-control freeze on the receiving account. This can delay further movement of the assets.

However, a freeze is only a temporary measure. Permanent action requires law enforcement to issue formal freeze orders to the exchange.

Engaging Law Enforcement

1. File a Police Report

Reporting a theft to the police doesn’t guarantee recovery, but failing to report almost certainly eliminates the possibility. Exchanges cannot arbitrarily seize user assets without legal authorization. Only after law enforcement issues a freeze order, backed by legal procedures, can an exchange lock the involved accounts or redistribute assets per court rulings.

Filing a police report and achieving case registration are critical steps to involve exchanges in the recovery process.

2. Navigate Filing Challenges

In some regions, particularly in China, filing crypto-related criminal cases can be difficult due to varying local policies and limited understanding of crypto among law enforcement. Success depends on choosing the right jurisdiction and preparing thorough documentation.

Crypto-related cybercrimes often have flexible jurisdictional rules, so select a jurisdiction based on the case specifics. Prepare a detailed criminal complaint, including a written report, similar case precedents, and the funds flow chart. These materials strengthen your case and assist officers unfamiliar with crypto investigations.

What If the Police Refuse to File?

In practice, victims may face pushback, with police citing that virtual currencies are “unprotected” or trading is “illegal.” The standard process involves:

- The duty officer records your statement in an Inquiry Transcript.

- You submit your complaint materials and sign an Evidence Receipt.

- The police issue a Case Acceptance Receipt, which serves as proof of formal case registration and your basis for pursuing further action.

Per legal guidelines, the police must review a case within 3 days. If further investigation is needed, this extends to 7 days, or up to 30 days for complex cases with approval from senior officials.

If you receive a Case Filing Notice, your case is officially registered. Law enforcement can then issue freeze orders to exchanges, potentially apprehend suspects, and pursue recovery through legal channels.

If you receive a Non-Filing Notice, you can request a review from the police or seek prosecutorial oversight to push for case registration.

Crypto theft and fraud cases are challenging to pursue due to their complexity and jurisdictional hurdles. Retail investors should consult reputable security firms or legal professionals for guidance and avoid rushing into decisions that could lead to further complications.

Avoiding Secondary Scams

The market is rife with dubious “asset recovery” teams. Exercise extreme caution to avoid falling for secondary scams. Vet any service providers thoroughly, and don’t let the promise of quick recovery lead to further losses.

Conclusion

Recovering stolen crypto assets requires a multi-pronged approach: securing remaining funds, tracking stolen assets, engaging exchanges, and pursuing legal action. While the process is complex and success is not guaranteed, proactive steps and professional advice can significantly improve your chances of mitigating losses.